Michael S. Smith is chief financial officer (CFO) and interim chief risk officer (CRO) of Voya Financial, Inc. (NYSE: VOYA), which helps Americans plan, invest and protect their savings — to get ready to retire better.

Smith — who became CFO in November 2016, interim CRO in April 2019, and also serves on Voya’s Executive Committee — is responsible for strategic finance, risk, capital management, actuarial, tax, insurance investments, controllership, financial reporting, procurement operations, expense management, treasury and investor relations. Smith also oversees Voya’s legacy individual life insurance and annuities businesses, which generate approximately 20% of Voya’s adjusted operating earnings.

Smith has held several leadership roles during his tenure at Voya. From January 2014 to September 2016, he served as chief executive officer (CEO) of Insurance Solutions. In this role, he led Voya’s Individual Life and Employee Benefits businesses to achieve higher returns on capital, introduce new technologies and generate greater value for Voya’s customers, distribution partners and shareholders. Under Smith’s leadership, both the Individual Life and Employee Benefits businesses generated higher returns on capital. He also oversaw significant in-force premium growth in Employee Benefits and successfully shifted the company’s Individual Life sales to indexed life insurance products.

From May 2012 to January 2014, Smith served as Voya’s CRO, and was responsible for overseeing the enterprise-wide and business-level risk monitoring and management program for the company. He joined Voya in 2009 as CFO and CRO of Annuities, and subsequently served as CEO of Annuities. In addition to his other roles at Voya, Smith continued to oversee Voya’s legacy variable annuity business until its sale in June 2018.

Prior to joining Voya, Smith held several leadership positions at Lincoln Financial Group, where he ultimately served as head of profitability and risk management of the company’s Retirement Solutions business. He also served as CFO and CRO of Lincoln Life and Annuities, from 2004 to 2006, and as CFO for Lincoln Financial Distributors, from 2003 to 2004.

Smith holds bachelor’s degrees in economics and Russian studies from the University of Michigan and attained Fellowship in the Society of Actuaries in 1990. He is a member of the American Academy of Actuaries and has been a CFA® Charterholder since 2003. Smith serves on the boards of The Actuarial Foundation as well as People’s Light & Theatre Company.

Serving the financial needs of approximately 13.8 million individual and institutional customers in the United States, Voya is a Fortune 500 company that had $7.5 billion in revenue in 2019. The company had $606 billion in total assets under management and administration as of June 30, 2020.

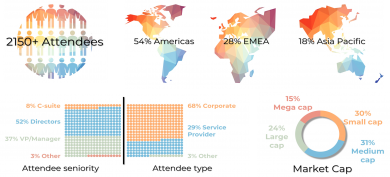

Showcase your knowledge in your chosen topic, region or sector

Showcase your knowledge in your chosen topic, region or sector