OUR UNIQUE FORMAT

The IR Magazine Think Tank – Europe will take place Thursday, June 26 in London and was an invitation-only event exclusively for senior IR officers. Our think tanks are free to attend and our unique format enables participants to network extensively, discuss, debate and dissect topical issues affecting today’s IROs.

What makes our format so unique?

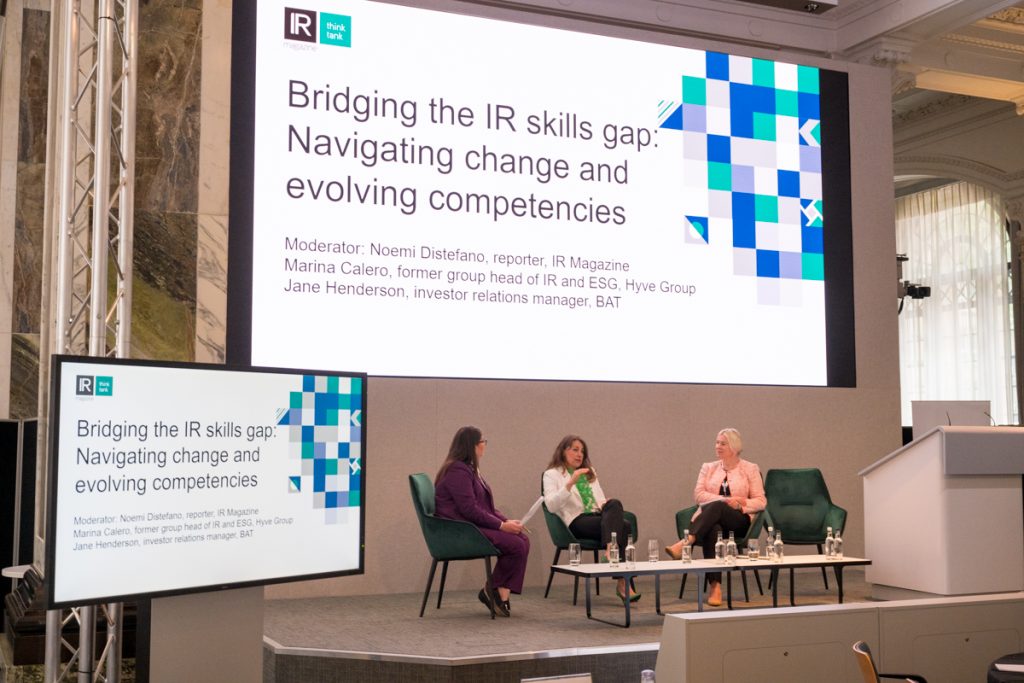

Our think tanks are far removed from the traditional conference setup as the event consists of panel sessions followed by roundtable discussions on select IR issues. These interactive sessions are an opportunity to share experiences with and learn from other top-rated investor relations professionals. All table discussions are confidential, and none of the participants’ comments is attributed, allowing attendees to talk freely and have frank, open discussions.

How do our roundtable discussions work?

Industry experts, top-rated IROs and members of the investment community set the agenda for a panel discussion by sharing their thoughts on session topics.

Small round tables of IROs discuss these issues face to face.

Each table gives feedback and shares ideas with the group as a whole.